In my last post, I described some important questions you need to ask yourself to determine your readiness to start earning miles and points with credit cards. Below are some frequently asked questions I have gotten from people interested in the miles game. The information below is based on what I have learned and what has worked for me over the last 18 months.

Really, in comparison to other people in the miles-earning game, I am a rookie hacker/miles earner. But I hope that even my basic knowledge and experience will encourage others to get started and maybe even help some people who are already in the miles game.

Seriously, earning miles to pay for the cost of flights is worth it even for the casual traveler. Why pay so much on airfare when you don't have to?!

What credit card(s) should I sign up for?

No one person can tell you which card is right for you – it'll come down to some research and consideration on your part. There are many resources and other miles-earners on the web who are constantly posting about the latest and greatest sign-up bonuses and credit card offers out there.

Instead of doing again what is already being done so well, I will just provide a few excellent resources below. These helped me out when I was just beginning, so I am simply paying it forward by linking to them.*

The latest discussion in the miles-earning world – browse or post a specific question and you'll usually get insightful advice in a few hours or less

Darius and Emily outline some great starter cards, calculate their value, and provide advice on what to say to credit card representatives over the phone.

This blog site has charts that break down current credit cards in different ways: by best signup offers, spend categories, and more. Scroll over "Credit Cards" on the nav bar.

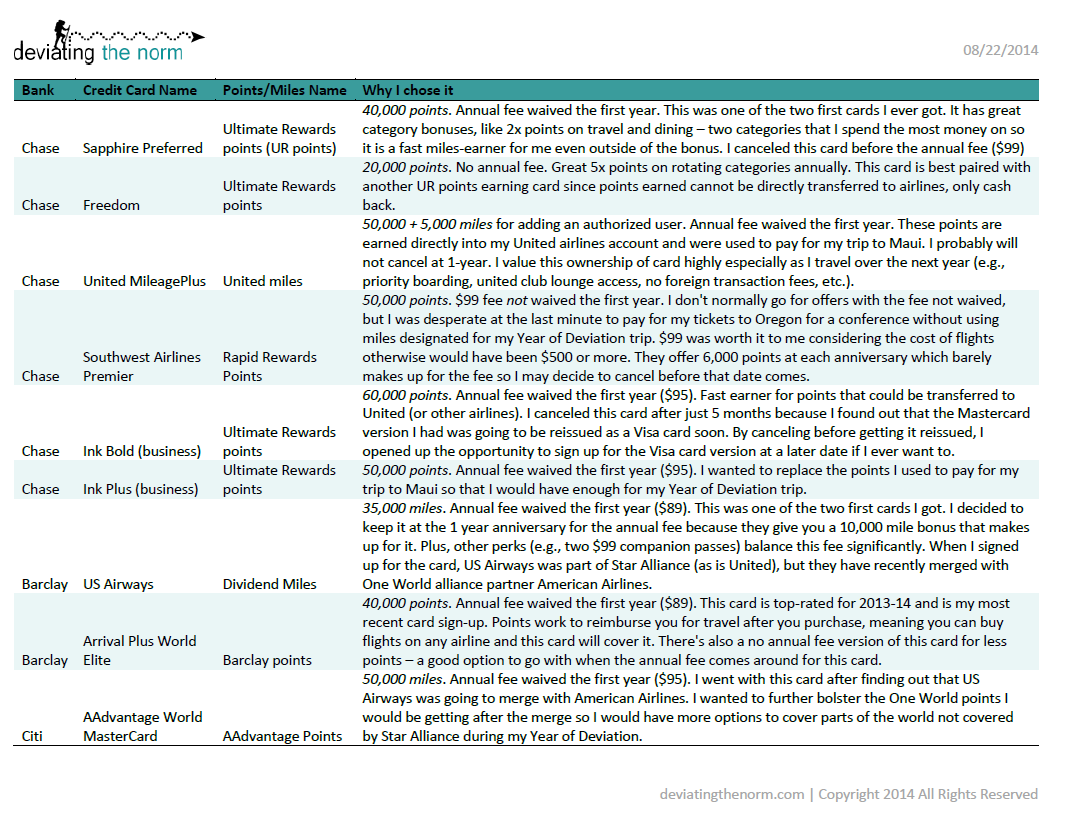

The cards I applied for and why:

How many cards should I sign up for at one time?

Many people who get into the miles game become card "churners." They apply for many cards in one sitting, get their sign up bonuses, then cancel the cards after a year goes by before the annual fees kick in. This is what I did for the last 18 months, but churning may not be right for you.**

For the first step, you'll need to determine how many miles you are aiming to earn. Are you taking one short trip for which you will need just a few thousand miles or a longer trip or many trips for which you will need lots and lots of miles like what I am doing for my Year of Deviation? If you're doing a short trip, one or two cards may be able to cover the flights for you, and that's it. If you aim to earn many miles, however, credit card churning will be the way to go. Use this Max Your Milez simulator to determine how many miles your trip will require.

The second step is to decide how many cards you personally feel you can handle right now. If this is your first time, I would recommend applying for just one or two cards in one sitting (one "churn"). Get a feel for things and then you can try applying for more cards again. I found that applying for one or two cards each churn was more than sufficient to meet my goals in less than 2 years.

Finally, you will need to consider two key components to safe-guard your credit score before you begin the credit card churning process:

(1) TIME: Many hardcore churners wait 90 days between churns. Here is why. As described in the last post, your credit score is determined by many different factors. Two factors are: (a) hard inquiries on your credit report; and (2) the length of your credit history which is the average age of your oldest credit card and newest/most recently approved credit card (e.g., 1 card that you've had for 12 months and 1 card that you were just approved means you have a 6-month credit history).

Your credit score will most likely temporarily drop when you first apply and are approved for a new card(s). A benefit of applying for multiple cards at once is that credit card companies will not see hard inquiries or the decreased credit history on your report since you are applying to the cards simultaneously. Many churners apply in the same day for as many cards as they can handle to ensure the best possibility of approval for the most number of cards.

Then, as a rule of thumb, churners will wait 90 days to do another churn—to apply for another group of credit cards all on the same day. This process allows time for their credit score to bounce back from any hard inquiries and decreased credit history length.

(2) YOUR FINANCES: Ensure that you do not get credit card application happy and end up missing out on sign-up bonuses and/or ruining your credit score. Before you sign up for one card or many at once, determine how much you would have to spend on each card to meet the sign-up bonuses.

Don't go over your budget. Start by figuring out how much you spend in a given month. Calculate the time it will take and amount it will take to earn the bonus(es) for the card(s) you want. For example, if your normal spending is about $1,100 total every month, you would reasonably be able to meet a sign-up bonus for a credit card requiring you to spend a minimum of $3,000 in 3 months.

If you sign up for another card at the same time that requires you spend $5,000 in 5 months, you will go over your normal monthly spend running the risk of not being able to pay your bill at the end of each month. Spread between these 2 hypothetical cards, $8,000 total in spending over 5 months is about $1600 a month.

You may be able to meet both cards' bonuses if you have an unusually large expense coming up. You were going to buy that TV soon anyway, right? So now you do it intentionally with one of these new cards and then reap the benefits of the sign-up bonuses later.

What are some strategies for ensuring I get approved for a new card?

Besides having a credit score above 700 to begin with, always calling the credit card company immediately after submitting the online form is good practice. Find out the bank's credit card reconsideration number and say something like, "Hi I just submitted an application for the [insert card name here] online. I'm calling just to see if there's any additional information I can provide to help expedite the processing of my application."

They will ask for an application number but you won't have one yet, so just offer to provide them with your SSN and they will find your submission. When I fill out the application I always make sure to remember what I put down as my income and other important information. They usually ask you for this information over again.

Most of the time, they will approve you directly over the phone and tell you your credit card will be in the mail in a few business days. Sometimes they will say you will find out by mail if you received approval. Finding out by mail does not mean your application will be rejected. I have been approved both ways before, immediately over the phone and through mail only.

It's not fair—the biggest bonuses are for business credit cards. How do I get one of those?

It's true. A lot of times the best/biggest bonuses are offered through business versions of cards. Business cards are not just for people who own a big company. You may have a business and not even realize it! Have you ever sold something on eBay before?

Do you sometimes get paid for doing extra work outside of your main job—like editing, data analysis, design work, baby-sitting, anything! No matter how small the income you make from it, if you have provided a service or product and received some sort of profit then you may be eligible for a business credit card.

I build websites on the side. In no way did this pay the bills for me in graduate school, but it was a source of income and counted as a fledgling business. I used this post from Million Mile Secrets to learn just what to say over the phone with the credit card representative in order to ensure approval for the card.

I've gotten two business credit cards since—and earned many miles through them due to their unique category bonuses (e.g., 5x points at office supply stores). It's also possible to have both a personal and business version of the same card—which means more points for you!

How can you maximize the points you earn?

Some of these options will work for non-card holders, too (for details, see previous post). I've marked those as NCH.

Purchase everything on your card, everything.

Ask friends if they will allow you to pay for an entire bill on your card and accept cash from them in return.

Get a Bluebird account to pay with your credit card for things you would normally pay with a check. (Learn this strategy here and here)

Fill out surveys online (NCH)

Strategically purchase items from certain companies just because they offer miles (NCH)

Sign up for miles dining programs and eat at participating restaurants (NCH)

Shopping portals (NCH)

Signing up for emails to receive special offers (NCH)

Follow airlines on social media and look for special offers (NCH)

Manufacture spending using your card***

Do I have to pay an annual fee for credit cards?

Annual fees are often waived for the first year to get you to sign up initially. If they don't waive it, go with another card option (especially if it's your first credit card or first miles-earning card). They may offer the card with the fee waived at a later date.

Alternatively, weigh the cost of paying the fee against the value of what the card is offering – sometimes you'll find that the fee is worth it to a degree. Meaning, it may pay for itself in the year that you have it. But be careful, its value may decrease as you continue to pay the annual fee each year.

At the anniversary of signing up for a card with the fee waived, call up the credit card company and negotiate with them. If they cannot offer you something worth your while to stay, cancel. Make sure to stop spending on the card a month or so before the year is up. This ensures that you don't lose any miles that haven't posted to your account yet if you decide to cancel.

If you have another card with that bank, see if they will transfer your credit on that card to the other one. This way you do not lower your overall credit limit which can have a negative impact on your credit score. Alternatively, determine if the benefits of keeping the card for another year outweigh the cost of the fee. For more on canceling and when to cancel, read up here.

--

*I do not get a commission for any of the links above. I am simply providing this information because I want to "share the wealth" so to speak.

**The above should not be taken as professional financial advice. This is just what has worked for me and is based on my own opinions, finances, and experiences. You need to be the final decider and do the research yourself to determine what is best for you.

For example, if you plan on taking out a large loan in the next 1-3 years (e.g., house loans, student loans, etc.) then I do not recommend applying for more than one or two credit cards. You want to be certain you get that loan and that credit card inquiries or mismanagement does not prevent you from being approved.

***When all else fails, there are some ways to manufacture spending. In addition to maximizing points, this can help people with lower incomes/monthly expenses to meet sign-up bonuses. While some feel manufactured spending falls outside the realm of what they are comfortable doing to earn miles, others feel these are legitimate loopholes that exist to be exploited until they are no longer available.

You'll have to decide what is comfortable for you. For more about the one that I used regularly, go here or contact me directly. These may not be viable options forever (as they become common knowledge), so I do not want to contribute to making them go away more quickly by posting about them in detail. UPDATE: The source that I used to use (Amazon Payments) is no longer available after October 13, 2014. Sad to see it go, but I totally get why it was only a temporary thing. I'm hoping something will replace it in the near future and will update this as I learn more.